Consider This: Mortgages

By Jimmy R. Hammond

New or used home, young or old buyers, housing and mortgages are a constant topic of today's conversation. As part of the baby-boomer generation, the discussions I experience now center around the type and location of a house that is best for someone getting older, but not old yet. Then there is the other end of the age spectrum for the starter house generation. Their questions are more about should I buy or rent, how much house can I afford, and of course, the common question for all buyers is what is a good mortgage rate? I have become more attuned to this discussion, as I presume many of you have, because of my adult children. I can still remember what seemed like insurmountable odds as we contemplated buying our first house back in the late '60s and our anxiety and our parents' shock when we announced that we were buying a house that cost $25,000. Circumstances have certainly changed. Today it is not uncommon to see properties listed and sold around Annapolis and Anne Arundel County from $250,000 to $2,500,000. You need go no further than the real estate section in this and every edition of Inside Annapolis magazine to see just a sampling of properties and what they sold for. Check out the table of contents for the specific page reference in this issue.

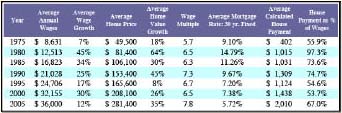

For my purposes here, I have looked back 30 years for a few key indicators, trying to glean something from the history. Perhaps this can encourage and/or assist others in purchasing that dream home, or at least assist them when they find the one they want and can afford. I have created a historical perspective assembled from data found on the Social Security Administration (www.ssa.gov), Department of Labor (www.dol.gov) and Fannie Mae (www.fanniemae.com) web sites along with a few other basic computations in the table below, which I hope will be of help in our discussion.

As you can see from the table a few things have really changed in America. Just 30 years ago the average American worker was earning around $8,631. I know you may have made more, but remember that we are working with averages here. At that same time, the average home purchase price was selling for $49,500 with a 30-year fixed mortgage rate of 9.1%. Yes, it did take more than average wages to buy at some of those levels. Like today, however, we all lined up to do whatever was required to buy our own home. It was just as difficult to buy a home in 1975 and like all other home buyers before us, we relied on real estate growth history which told us that real estate would only continue to rise in value as it had done since 1945 when a very nice home cost $5,000. It should be noted that in my table I assumed 100% financing on a $49,500 home purchase with a 30-year fixed rate of 9.1% to get a monthly principal and interest payment of $402. I made similar calculations for each of the subsequent 5-year periods in the table.

Here we are today again 30 years later, bewildered and confused! Average wages have gone up less than 4.2 times and average home prices have gone up 5.7 times, but interest has gone down from 9.1% to 5.72% or even lower today at a 40% plus drop. All-in-all, I would say that today's real estate buying circumstances are not dissimilar to 30 years ago, even if the numbers look much larger. It still takes about 60% or less of your earnings for today's house purchase. If you are interested in checking out the mortgage level you may qualify for, visit any one of the numerous sites like www.bankrate.com and the link "What can I afford?" or just Google "mortgage qualification formula" for more responses than you can count.

Significant and positive changes have occurred during the same 30-year period. The Federal government now allows most people to buy and sell their personal residence without reinvesting the proceeds in another home or paying a tax on the gain. Lenders have helped mightily with countless lending plans from 1-5 year interest-only loans to biweekly plans over 15 years. Builders continue to make bigger and more extravagant houses than most of us can even dream about, but in general, average-size houses are trending down to a more realistic 2,000 square feet on smaller parcels of land. The real is problem is location, location, location.

Remember that the Federal and State governments, the builders, the lenders and the real estate businesses still are trying to help everyone buy their dream house. Be patient, be persistent, watch the rates and react quickly. Your house is out there waiting for you!

If you have comments or suggestions, or have an idea for a future computer or business topic, e-mail me at Jimmy@CapitalConsultant.net or Jimmy@InsideAnnapolis.com Jimmy R. Hammond, CPA, is a resident of Annapolis and a consultant to businesses in

Annapolis, Baltimore and Washington D.C.

|

Back

|