Consider This...

Minimum Wage Facts

By Jimmy R. Hammond

If you reside in a different country or haven't read a US newspaper over the past 60 years, you may have missed the arguments being made by many in the Federal and state governments constantly to review and increase the minimum wage.

Before we venture too deeply into the merits or lack thereof of this program, let's look back the history of the Minimum Wage. According to the Department of Labor (DOL) the first version of the Federal Minimum Wage Rates under the 1938 Fair Labor Standards Act established a mandatory minimum of $.25 an hour as a protection device against big business for those workers engaged in interstate commerce. The minimum wage, according to my readings, had nothing to do with raising families or cost of living issues. Many states and US territories followed the US initiative. As of January 1, 2005 there were 30 jurisdictions, including Maryland, Guam and Puerto Rico that have adopted the Federal law and rates, there are 11 jurisdictions that have a higher rate; there are 7 jurisdictions that do not have a minimum wage rate and finally, there are Kansas at $2.65; Ohio $2.80-$4.25 and the US Virgin Islands at $4.30-$4.65, obviously all with lower rates than the Federal Minimum unless the jobs fall under the Fair Labor Standards Act. The Federal definition of workers has been expanded continuously over the past sixty-seven years and now includes nearly all working persons compensated by the hour while the Federal hourly rate rose to $5.15 where it has been since 1997. The DOL map above gives a better picture of where each jurisdiction stands on this issue. Before we venture too deeply into the merits or lack thereof of this program, let's look back the history of the Minimum Wage. According to the Department of Labor (DOL) the first version of the Federal Minimum Wage Rates under the 1938 Fair Labor Standards Act established a mandatory minimum of $.25 an hour as a protection device against big business for those workers engaged in interstate commerce. The minimum wage, according to my readings, had nothing to do with raising families or cost of living issues. Many states and US territories followed the US initiative. As of January 1, 2005 there were 30 jurisdictions, including Maryland, Guam and Puerto Rico that have adopted the Federal law and rates, there are 11 jurisdictions that have a higher rate; there are 7 jurisdictions that do not have a minimum wage rate and finally, there are Kansas at $2.65; Ohio $2.80-$4.25 and the US Virgin Islands at $4.30-$4.65, obviously all with lower rates than the Federal Minimum unless the jobs fall under the Fair Labor Standards Act. The Federal definition of workers has been expanded continuously over the past sixty-seven years and now includes nearly all working persons compensated by the hour while the Federal hourly rate rose to $5.15 where it has been since 1997. The DOL map above gives a better picture of where each jurisdiction stands on this issue.

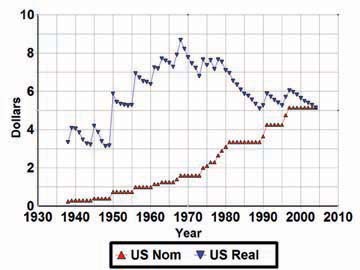

According to the Employment Policy Institute, "Proponents of a federally mandated increase in the minimum wage have stated that the wage floor is no longer able to support working families with children, and should be returned to the 1968 value, when the minimum wage was at its peak in real value. Proponents of wage floor increases claim that the real value of the minimum wage has steadily fallen over the past few decades due to inflation, and has thus hurt families with children. According to the Employment Policy Institute, "Proponents of a federally mandated increase in the minimum wage have stated that the wage floor is no longer able to support working families with children, and should be returned to the 1968 value, when the minimum wage was at its peak in real value. Proponents of wage floor increases claim that the real value of the minimum wage has steadily fallen over the past few decades due to inflation, and has thus hurt families with children.

The data shown on the next page shows that while the nominal value of the minimum wage has not changed since 1996, the real value of the minimum wage in 2002 dollars (adjusted for inflation), plus the real value of the Earned Income Tax Credit (EITC) for a full-time minimum wage employee with two children is only 7.6% lower today. Increases in the EITC have helped retain the value of the minimum wage for employed families, thus maintaining much of their overall spending power over time. Using the EITC allows our government to effectively target assistance to the small proportion of the workforce raising families on low incomes, instead of a blunt and unfunded minimum wage mandate which would inefficiently distribute assistance to individuals without children or in dual-earner situations."

As you can see, the arguments are no longer about worker protection but are now focused on benefits, poverty levels and raising families.

A graph created by the Oregon State University (OSU) provides a clear picture of the changes over the life of the minimum wage. The OSU graph shows real dollar values of at all minimum wage levels paid since 1938 using the 2004 dollar value. It is easy to see that even at $.25 an hour in 1938 the real value was greater with a continued positive divergence until 1968 and then the subsequent decline to today. As previously noted, the decline in real value has been slowed by the introduction of the Federal Earned Income Tax Credit (EITC) for lower level wage earners. For the 6.7 million lower level workers, or persons making less that $23,660, the rule was further enhanced by the DOL 2004 regulatory changes in overtime eligibility rules. For persons in this lower category, mandatory overtime rules increase the hourly rate to $7.73 when working over 40 hours per week. It certainly helps to know if you work more you earn more, rather than work less earn more.

There is no easy answer here, but it is clear to me, that the minimum wage may have evolved into a social safety net more than a check on abusive corporate power. Ironically, jobs at these lower levels have become economic magnets for the millions of illegal and legal immigrants. There doesn't appear to be any coordinated legislative group working on a change since an ill-fated attempt to increase the minimum rate a couple of years ago. When it does resurface - and it will - I hope this will help you understand how we got there.

If you have comments or suggestions, or have an idea for a future computer or business topic, e-mail me at Jimmy@CapitalConsultant.net or Jimmy@InsideAnnapolis.com.

Jimmy R. Hammond, CPA, is a resident of Annapolis and a consultant to businesses in Annapolis, Baltimore and Washington D.C.

|

Back

|